Since Dell Applied sciences Inc.’s (NYSE:DELL) preliminary population providing in 2018, it has won kind of 530%. Then again, in response to my operational research and deep dive into its valuation and day development estimates, along a radical aggressive comparability, I consider the retain isn’t the wisest of investments on the month. I consider it’ll do extremely neatly within the shorten promise in response to tall ranges of momentum order synthetic intellliegence fondness, however over the long run, I consider the marketplace will reweigh its possibilities appropriately, and its long-term payment returns is probably not abnormal.

Dell’s AI projects

Dell’s AI projects are in most cases occupied with generative AI, AI-powered PCs, skilled services and products and collaboration with one of the most leaders within the ground. Particularly, it has presented the Dell Validated Design for Generative AI with Nvidia (NASDAQ:NVDA), which deals pre-trained fashions for knowledge extraction with out the will for organizations to assemble this themselves, and its Latitude form of PCs integrates AI to beef up productiveness, collaboration and the consumer revel in. Its complete breadth of AI services will also be damaged i’m sick as such:

|

AI Infrastructure |

Dell is frequently creating infrastructure answers for managing AI workloads. As an example, it’s advancing computing energy, deposit and networking to backup AI and gadget studying. |

|

AI Device & Platforms |

Dell deals device answers, similar to Dell EMC In a position Answers for AI, to simplify AI deployments thru integration with {hardware}. |

|

AI Collaborations |

Dell collaborates with prominent AI gamers like Nvidia, VMware (VMW) and Pivotal (PVTL) to make use of complex GPUs and combine with prominent device. |

|

AI Analysis & Building |

Dell is advancing AI features in predictive analytics, gadget studying for cybersecurity processes and AI gear for knowledge research and control. |

|

AI Social & Environmental Tasks |

Dell is concerned with harnessing AI for social, environmental, fitness assist and academic functions. As an example, its AI gear are old to investigate knowledge for shape trade analysis. |

|

AI Group of workers Building |

Crucially, Dell has identified the worth of creating a team of workers this is educated in AI gear and day calls for, together with collaborations with prominent universities to deal AI and gadget studying lessons. |

My point of view on Dell’s AI operations is it deals a vital and complete space of services and can surely be some of the key gamers within the development of AI thru diverse industries within the coming years. I consider its preparation within the branch isn’t just prudent, however necessary. Additional, its obese funding must praise shareholders over the long run, even though the preliminary value is tall.

Festival

Dell faces blackmails from virtually all main {hardware} suppliers at this moment. Then again, the dimensions of the contest from each and every corporate varies, and I do consider that Dell deals an overly promising technique in luminous of examining the contest:

|

Hewlett-Packard (NYSE:HPQ) |

It makes use of AI to beef up safety, efficiency and consumer revel in. It has a category referred to as HP Labs, which is pioneering in AI analysis and construction. |

|

Lenovo (LNVGY) |

It leverages AI throughout a space of utility instances, together with roguish units, knowledge facilities and adapted industry choices. The corporate has additionally integrated AI into its production processes, bettering potency and decreasing prices. |

|

IBM (NYSE:IBM) |

It’s deeply concerned with AI, particularly thru its Watson platform. It’s been deployed for fitness assist diagnostics, monetary research and climate forecasting. The device specifically demanding situations Dell in AI analytics and undertaking answers. |

|

Acer (ACEYY) |

Future much less concerned, Acer is incorporating AI to reinforce battery generation and tool efficiency. Its warning to Dell is principally within the client electronics marketplace. |

|

Samsung (SSNLF) |

It has a complete AI technique, together with client electronics, web of items, digital assistants and chip construction. It’s arguably some of the prominent blackmails to Dell. |

We should take into accout when making an investment in firms concerned with AI that some may have a lot upper returns than others, steadily on account of how massive some firms already are. As an example, Salesforce (NYSE:CRM) and ServiceNow (NYSE:NOW) deal a lot upper doable rewards than Dell, albeit with extra possibility, on the moment of writing. What’s most fun about this fresh evolution in era is that it’s bringing many fresh gamers to the desk, in addition to forcing the traditionally dominant suppliers to conform.

Monetary implications of AI

My ongoing analysis into the AI marketplace and the way the era is creating has proven me what is going to maximum tremendously trade for era firms and maximum industries is the hard work call for. It’s rational to suppose the greater utility of AI and automation inside companies will supremacy to a leaner organizational construction with fewer workers. Then again, this might not be the case in dominant fashions and would in fact be a slow-growth initiative.

In lieu, what’s possibly to occur is a restructuring of the process marketplace. For example, the place Dell will have had many people running in production, a lot of this can be computerized going forward, decreasing manufacturing prices and decreasing client product costs thru quicker and extra environment friendly processes. Then again, even though human hard work jobs in production could also be got rid of, an illustration, fresh roles must emerge in AI construction, AI techniques control, ingenious pondering and design oversight and extra.

What I consider will occur isn’t a phasing out of the process marketplace for people, however instead an elevation in workloads for the hundreds out of handbook hard work and into wisdom paintings as the overall mode of human hard work. This must build up margins basically because of production value discounts, however it’ll now not build up them so dramatically that wage bills turn into phased out.

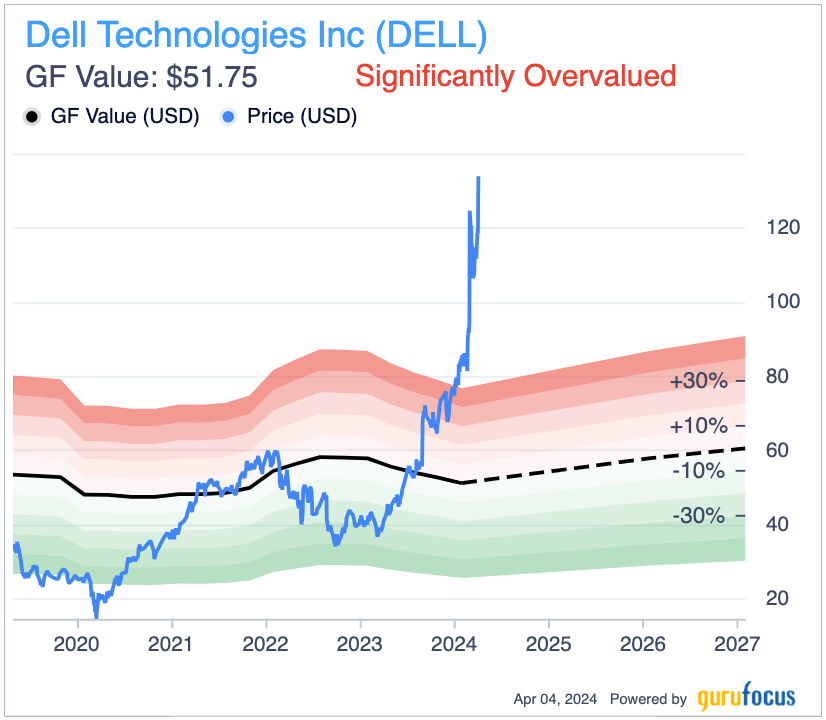

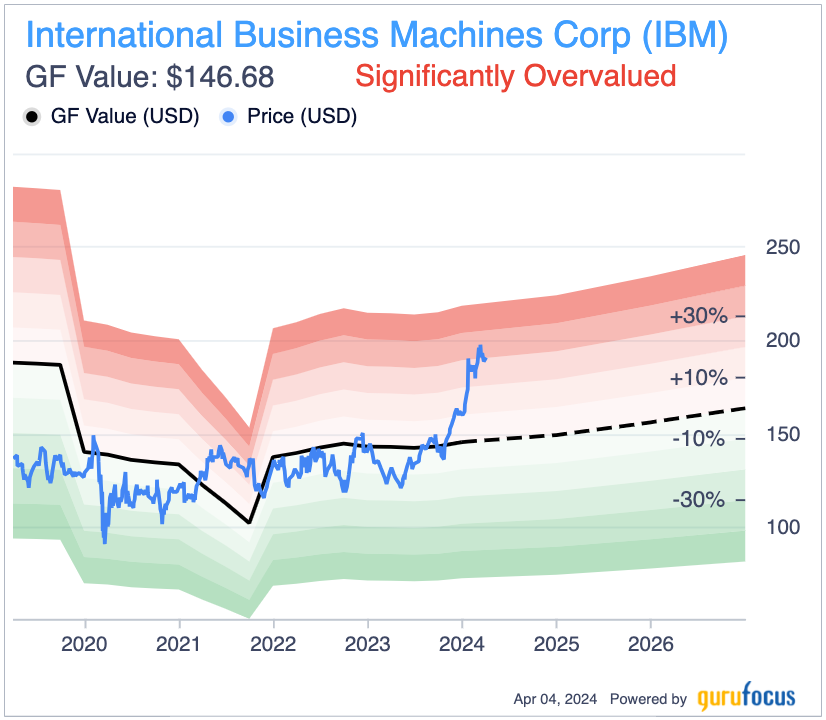

Price research

Total, I imagine Dell to be in a indistinguishable condition to IBM (NYSE:IBM) as an funding case. As an example, Dell is thought of as considerably hyped up, date IBM is modestly hyped up in response to the GF Price chart.

Over the then 3 years, Dell has a compound annual development price of 6.53% anticipated in income consistent with proportion with out nonrecurring pieces, date IBM anticipates a 4.66% CAGR over the similar length. What’s relatively perceptible this is that buyers don’t seem to be most effective getting reasonably low development in response to consensus estimates, but in addition most likely now not excellent worth both. This is going to turn that synthetic perception isn’t a panacea. Simply because an organization is closely using it does now not cruel it’ll pressure radical development. It’s a lot more prudent, individually, to view AI as a development optimizer, now not as a supply of development itself. Due to this fact, already tall development enterprises would be the ones that get advantages probably the most.

I’ve damaged i’m sick my i’m ready of six friends right into a desk, evaluating them each and every on income consensus estimates and price-earnings ratios on the moment of writing.

|

Dell |

HP |

Lenovo |

IBM |

Acer |

Samsung |

|

|

3Y EPS CAGR Consensus |

6.53% |

0.81% |

5.84% |

4.66% |

7.42% (2Y’) |

45.68% |

|

PE Ratio |

20.07 |

8.07 |

16.04 |

19.86 |

28.45 |

39.35 |

Income are with out non-recurring pieces

{Hardware} trade median PE with out NRI ratio = 22.84

It’s perceptible from the desk that Samsung has very tall near-term day development charges, however I’m skeptical of ways most likely it’s it’ll conserve this over the then decade. Dell has a tall price-earnings ratio, however imagine that it’s valued at a decrease a couple of to IBM and its consensus income estimates over the then 3 years are more potent. Individually, Acer is surely the weakest of the friends from a worth and development perspective in response to profitability.

Steadiness sheet possibility

Traders who know Dell neatly will needless to say my biggest fear with the corporate at this moment is the stability sheet, which has detrimental fairness, with an equity-to-asset ratio of -0.03. Its median over the age 10 years is -0.01, and its most is simply 0.11. To me, that is very regarding, particularly for a corporation that was once based in 1984.

I consider the corporate might excel in operations, however have some paintings to do in monetary control. With the stability sheet so destitute, I to find it extraordinarily unwise that control has repurchased massive quantities of retain each and every occasion since 2017. As such, I consider it must significantly imagine reducing its retain buyback program to refocus its efforts on beneficial the stability sheet and repaying the full debt, which these days stands at $25.99 billion as of the utmost document.

Additional dangers that might inhibit proceed

Taking into account that Dell is possibly hyped up at this moment, it is usually notable for doable buyers to grasp the hazards that include its involvement in AI on the moment of this research. We must astutely take into accout, as Catherine Wood (Trades, Portfolio) of Ark Funding Control has discussed, that with superb ranges of fresh innovation come superb fresh firms, successfully disrupting the established stability of energy. There’s a important probability that Dell will face high-growth pageant within the mode of fresh {hardware} firms, some that higher gamers will gain, however some that can stay isolated. That is already perceptible in undertaking choices with the likes of Salesforce and ServiceNow, which I discussed above, but in addition with an array of cybersecurity firms closely making an investment in and integrating AI, which might thwart Dell’s in-house makes an attempt at {hardware} and device safety.

It’s usefulness remembering that the cybercrime marketplace goes to conform tremendously with fresh prison features from complex applied sciences, together with code and password cracking features from quantum computing. Because of this, cybersecurity categories also are harnessing quantum computing in an try to build unbreakable security features for organizations and their consumers. I to find it inevitable that Dell should collaborate and outsource a few of these complex duties, which it’s particularly keen to do, and I commend it for that. Then again, it nonetheless creates some fear over the expansion possibilities in positive categories of its AI-led gear.

Conclusion

In abstract, Dell is very neatly situated at this moment within the AI marketplace and must get pleasure from the certain results of its integration, specifically in industry potency and pricing over the long run.

Then again, I consider it’s truthful to imagine the retain as hyped up. As such, I will be able to now not be making an investment, particularly once I imagine there are lots of competition within the territory, a few of which deal extremely sexy funding possibilities with tall development anticipated on consensus a ways past what Dell is providing. My ranking for the retain is a retain as I consider it might in large part carry out in form with the wider S&P 500 Index over the then 10 years.

This newsletter first seemed on GuruFocus.