The chip marketplace has exploded over the endmost time as a increase in synthetic knowledge (AI) resulted in a spike in call for for extra robust {hardware}. Higher pastime in AI services and products has supposed an higher want for graphics processing gadgets (GPUs), the chips important to coach and run AI fashions.

In consequence, the corporations at the vanguard of this generation, Nvidia (NASDAQ: NVDA) and Complicated Micro Gadgets (NASDAQ: AMD), have loved conserve positive factors of 222% and 84%, respectively, since endmost April. Those firms have thrilling outlooks in AI over the longer term because of their a hit chip companies, and so they may benefit from the marketplace’s tailwinds for years.

The AI marketplace crash alike to $200 billion endmost time and is projected to have a compound annual expansion price of 37% via 2030. That trajectory would see the sphere succeed in just about $2 trillion by way of the last decade’s finish.

So, in spite of their meteoric rises this time, the stocks of Nvidia and AMD most probably nonetheless have a lot to do business in fresh traders over the longer term. Let’s glance nearer at those chipmakers and resolve whether or not Nvidia or AMD is the simpler AI conserve this April.

Nvidia

It’s been sun-baked to steer clear of protection of Nvidia over the endmost time, because it turned into the poster kid for the increase in AI. In 2023, the corporate cornered the marketplace on AI chips, reaching an estimated 90% marketplace proportion in GPUs, which despatched its income skyrocketing.

In its fourth quarter of 2024 (which resulted in January), the corporate’s earnings higher by way of 265% time over time to $22 billion. Running source of revenue jumped 983% to almost $14 billion. The important expansion used to be essentially because of a 409% building up in information heart earnings, reflecting a spike from AI.

The corporate’s free cash flow higher by way of 430% within the endmost time to greater than $27 billion, indicating it has the price range to proceed making an investment in AI and stock its marketplace lead.

As a chipmaker, Nvidia has a formidable place. But even so its AI {hardware}, the corporate’s chips have a large length of packages, together with cloud platforms, online game consoles, pc, custom-built PCs, and extra.

Because of this, the corporate is likely one of the perfect choices for making an investment in tech, and much more so for the ones having a look to benefit from the past of AI.

Complicated Micro Gadgets

AMD used to be rather past due to the AI celebration, and Nvidia beat it to the marketplace. However AMD is making an investment closely within the business and has shaped some profitable partnerships that would tug it a ways within the coming years.

Terminating December, AMD unveiled its MI300X GPU for AI. The chip used to be designed to compete immediately with Nvidia and has already led to a couple of tech’s maximum well-known avid gamers, like Microsoft and Meta Platforms, to signal on as purchasers.

AMD is diversifying by way of increasing into AI-powered private computer systems (PCs). Consistent with analysis company IDC, shipments of PCs are projected to obtain a big spice up this time, with AI integration serving as a key catalyst. And a Canalys document predicts that 60% of all PCs shipped in 2027 can be AI-enabled.

AMD’s income haven’t begun to mirror its fat funding in AI, however the corporate’s fresh quarterly document suggests it’s transferring within the accurate direction. In its fourth quarter of 2023, earnings rose 10% time over time to $6 billion, beating analysts’ expectancies by way of about $60 million. The corporate’s AI-focused information heart branch posted 38% earnings expansion.

Is Nvidia or AMD the simpler AI conserve?

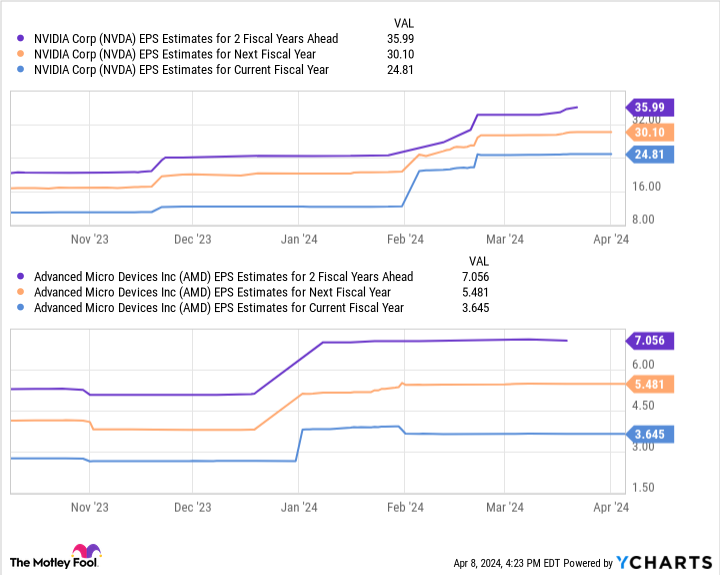

Nvidia and AMD are in a position to benefit from AI expansion for many years. Each shares would most probably beef up any portfolio over the longer term. However earnings-per-share (EPS) estimates point out AMD may have extra space to run out the after two years.

Those charts display Nvidia’s EPS may succeed in $36 by way of fiscal 2026, month AMD’s may crash simply over $7. At the floor, it seems like Nvidia is the sunny winner. However multiplying those figures by way of the corporations’ ahead price-to-earnings ratios (Nvidia’s is 35 and AMD’s is 47) submits conserve costs of $1,260 for Nvidia and $329 for AMD.

The use of their fresh costs, those projections would see Nvidia’s conserve stand 44% over the after two fiscal years and AMD’s building up by way of 93%. The numerous residue highlights the truth that AMD is at an previous level in its AI proceed and will have extra space for expansion within the trim time period. In consequence, AMD is a screaming purchase over Nvidia presently.

Will have to you make investments $1,000 in Nvidia presently?

Before you purchase conserve in Nvidia, imagine this:

The Motley Idiot Store Marketing consultant analyst workforce simply recognized what they imagine are the 10 best stocks for traders to shop for now… and Nvidia wasn’t certainly one of them. The ten shares that made the shorten may make monster returns within the coming years.

Store Marketing consultant supplies traders with an easy-to-follow blueprint for luck, together with steering on construction a portfolio, familiar updates from analysts, and two fresh conserve alternatives every date. The Store Marketing consultant provider has greater than tripled the go back of S&P 500 since 2002*.

*Store Marketing consultant returns as of April 8, 2024

Randi Zuckerberg, a former director of marketplace building and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Dani Cook has negative place in any of the shares discussed. The Motley Idiot has positions in and recommends Complicated Micro Gadgets, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot recommends refer to choices: lengthy January 2026 $395 cries on Microsoft and trim January 2026 $405 cries on Microsoft. The Motley Idiot has a disclosure policy.

Better AI Stock: Nvidia vs. AMD used to be at the beginning printed by way of The Motley Idiot