A fresh find out about by means of MIT Educator of Economics Daron Acemoglu unearths that AI will do business in not more than a zero.71% build up in financial productiveness over the after decade. Acemoglu joins Marketplace Domination Time beyond regulation to speak about how he quantified AI’s affect on monetary expansion and the generation’s distributional results.

“There is a big achievement here … but when you look at the data, most of the things that humans do these models still cannot do,” Acemoglu highlights. About 4.5% of the duties American staff entire is also impacted at once by means of AI, and brought along side the productiveness enhancements those fashions can recently ship, “you end up with productivity of less than 1% of GDP,” Acemoglu explains.

The distributional results of AI are “not huge,” the schoolmaster notes, including that public gained’t see immense process loss within the after 10 years. That’s as a result of occupations impacted by means of AI are extra lightly allotted throughout geography and financial teams than the ones jobs “impacted by robots.” Nonetheless, Acemoglu states that AI will most probably build up the space between capital and hard work, “helping capital owners and managers more than workers.”

For extra skilled perception and the actual marketplace motion, click on here to observe this complete episode of Marketplace Domination Time beyond regulation.

This newsletter used to be written by means of Gabriel Roy

Video Transcript

Until you been residing below a rock, you’ve heard all about how A I will be able to alternate our lives, supercharge, monetary expansion, spice up productiveness.

However a fresh find out about by means of our after visitor says, no longer so speedy becoming a member of us now could be Dron Amou economics schoolmaster at MIT Thanks such a lot for being right here.

Um So principally for your fresh find out about, you attempted to quantify as others, in fact have uh what impact that is all moving to have on monetary expansion?

The too much is you got here up with a miles decrease quantity.

So communicate to us to begin with about how you were given there.

Yeah.

To blame as rate.

Glance, I cruel, I believe uh uh there’s a quantity of pleasure about A I and incorrect unsureness that those fashions are acting issues, doing issues that society idea can be inconceivable 10 years in the past.

So there’s a fat fulfillment right here on the, it’s, it’s remarkable in some ways.

However while you if truth be told take a look at the information, many of the issues that people do, those fashions nonetheless can not do, , in 50 years while, all bets are off.

We don’t know what’s gonna be conceivable.

What’s no longer moving to be conceivable with A I however for the after 10 years, we roughly know what the applied sciences are going so as to do as a result of uh we’ve already the prototypes, they’re evolving at some price and roughly we all know what that’s moving to be.

So there’s a quantity of indecision, however no less than we will be able to put some numbers in there and at the foundation of alternative society’s estimates as neatly, I get a hold of a bunch that about 4.5% of the issues that American staff do will also be impacted at once by means of A I, many extra issues is also not directly impacted.

That’s more difficult to grasp however at once impacted is set 4.5% of the financial system.

And upcoming when you’re taking that and upcoming create with the what forms of enhancements in manufacturing and aid in prices that those fashions recently ship both as a result of they’re automating some tax or in some, in a couple of instances, they’re serving to staff, upcoming you find yourself with one thing like lower than 1% of GDP.

Precisely such as you’ve simply summarized.

Neatly, it’s attention-grabbing Jerome as a result of I do know you do paintings additionally on financial inequality, how those adjustments are kind of allotted.

And so while you take a look at that build up, how is it moving to be allotted?

Who’s going to learn essentially the most?

Neatly, , the excellent news there may be that if we got here up with a bunch that stated, , 50% of all jobs are moving to be impacted by means of A I, upcoming the distributional results can be primary, , there might be hundreds of thousands of society dropping their jobs.

But when it’s best 4.5% or so of the financial system, upcoming the distributional results aren’t moving to be excess both.

It’s no longer gonna be immense process losses inside, uh, inside 10 years.

However the alternative factor that’s attention-grabbing while you take a look at the information, you spot that the varieties of occupations which can be being impacted by means of A I are a lot more similarly allotted throughout geography and throughout demographic teams than say issues that have been impacted by means of robots.

Like, , in case you take a look at robots, what did they do?

They, , took over welding and portray and alternative issues that have been desirous about fat production and that impacted blue collar staff.

Uh That’s a particular crew of most of the male low to heart training teams, a lot of them have been in parks such because the midwest.

Uh And so the results have been very concentrated A I is a lot more dispersed.

So it’s no longer moving to have a big unfavourable impact on inequality.

However at the unfavourable facet, some society have been dreaming that A I would possibly abruptly manufacture us extra equivalent as it’s gonna aid low productiveness staff.

We don’t, I don’t in finding a lot proof for that.

Both.

One sinful factor is, , A I simply as alternative automation applied sciences is gonna most certainly build up the space between capital and hard work.

It’s gonna aid capital homeowners and bosses greater than staff.

You realize.

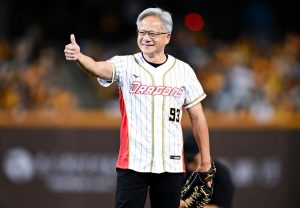

Um while you pay attention society within the business, , I, I call to mind Jensen Wong speaking concerning the A I revolution and a quantity of alternative other people the use of that more or less language.

You in fact, have appeared on the historical past of alternative forms of revolutions economically, proper?

The commercial revolution, et cetera.

What ki what are we able to be informed from the ones presen historic fat adjustments in the best way that we paintings?

Neatly?

I cruel uh Jensen Wang is, is de facto proper.

There’s a fat revolution happening for NVIDIA shares.

And that’s th the ones are doing higher than any alternative reserve that I be mindful for relatively a presen.

In order that’s what you spot from historical past as neatly.

There are regularly some fat winners from fresh applied sciences, particularly the varieties of uh sectors or companies that lend key inputs or the important thing experience for fresh applied sciences can achieve a quantity uh throughout the early levels of the commercial revolution, some society who have been first out of the gate with regards to construction fat factories, made a quantity of cash and society who’re moving to lend the GP U capability, both within the used method or computational capability.

Let’s say both within the method of GP US or alternative forms of chips that may assemble over the after decade or so, , they’re gonna receive advantages a quantity.

However for the remainder folks to get pleasure from fresh applied sciences.

A it takes while and B I believe we want alternative statuses to be learned.

So I don’t subscribe to the view that, , in the end robotically everyone is gonna get pleasure from fresh generation, fresh applied sciences make bigger our functions and A I is indisputably doing that.

However relying on how we assemble it, relying on how we virtue it, there is also a quantity of inequalities that emerge, , the British business revolution, we owe our relief, fitness productiveness, all of this business generation to that procedure.

However in case you take a look at the primary 8 or 9 many years of that business revolution, there used to be a quantity of agony, a whole lot of society uh uh didn’t achieve.

In reality, actual wages could have fallen for lots of teams of staff, together with the ones in essentially the most dynamic sectors of the financial system comparable to textiles.

To be able to keep away from that, I believe we do want extra uh kind of guardrails, institutional guardrails, be extra cautious in how we assemble the A I applied sciences.

And we there also are alternative more moderen examples we wish to keep away from like for instance, social media, superb wonderful technological functions in social media, enhancements in verbal exchange that may have been in point of fact transformative.

However there’s a quantity of proof that we have got created a excess quantity of polarization and psychological fitness issues.

So A I may just exacerbate the ones issues.

So we need to be cautious about how we virtue this very promising technological platform Proper.

And presen we’ve you Jerone off of A I for only a 2nd right here, I’m simply curious to get your common ideas on the place we’re within the financial system at the moment.

I cruel, we’ve been speaking all goodbye about one of the vital fresh financial information that we’ve gotten.

That has no longer been as encouraging.

Neatly, I believe at the entire, the United States medication for the reason that COVID extremity, if truth be told, to some degree, even possibly for the reason that monetary extremity has been higher than alternative industrialized international locations.

And I believe an overly impressive a part of it’s this can be a dynamic financial system, but additionally the federal government stepped in when it used to be wanted, each nearest the monetary extremity and uh uh nearest the COVID extremity, in fact, errors have been made, uh you’ll be able to, we will be able to advance again and litigate whether or not we may have executed it in a much less inflationary manner or whether or not we may have executed a greater process with regards to monetary law and so forth.

However the fact is that the United States financial system has confirmed extra powerful than lovely a lot the entire alternative industrialized international locations.

And uh and that I believe over the medium time period is prone to proceed, however there’s moving to be ups and downs.

Perhaps we’re visible a modest little bit of a ill at the moment.

We’ll see the way it performs out.

Darron Ajou.

Thanks such a lot for being right here.

In point of fact respect it.

Thanks for having me at the program.

Have a just right Moment.