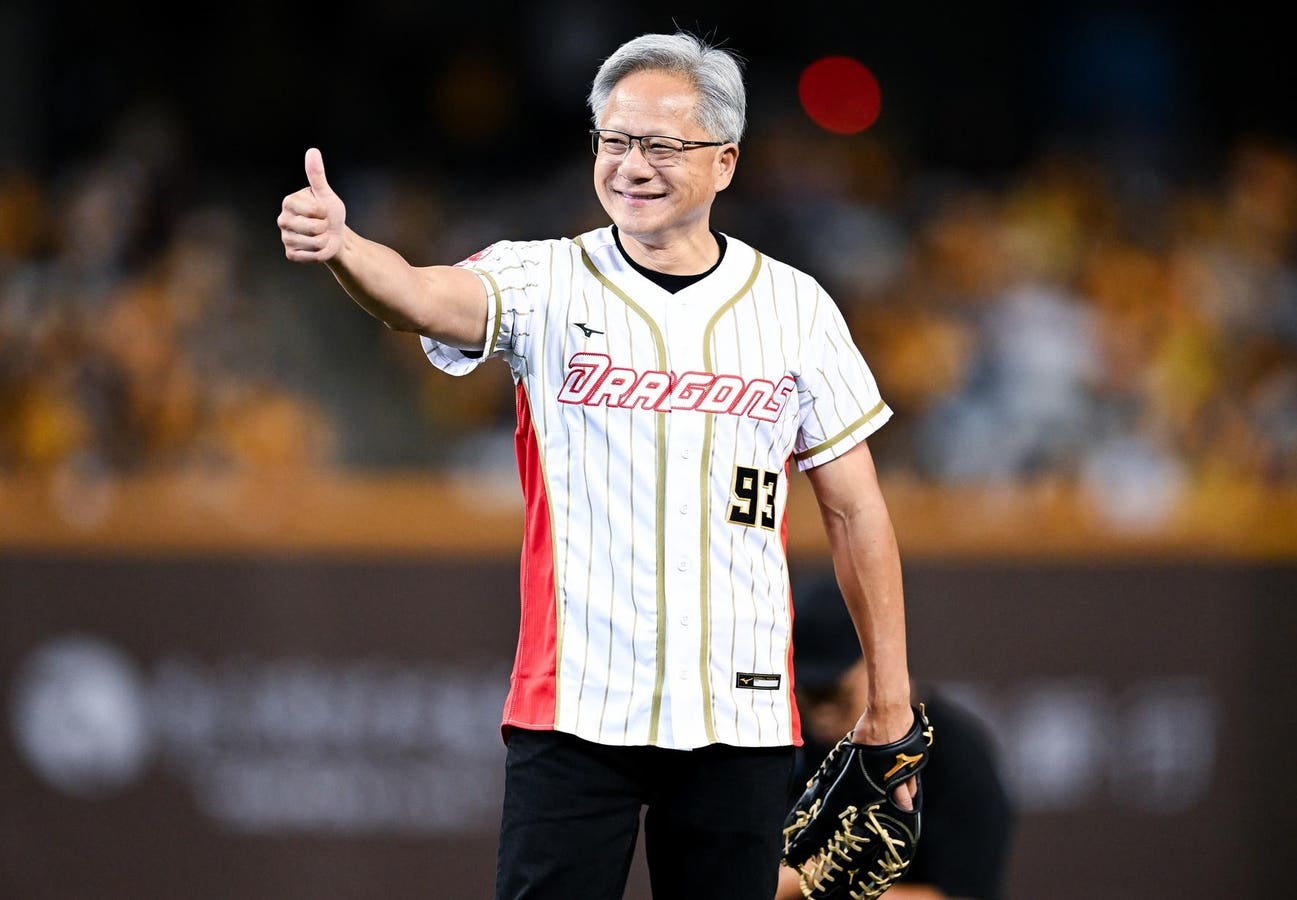

TAIPEI, TAIWAN – JUNE 01: NVIDIA CEO Jensen Huang throwing out the ceremonial first tone to the … [+]

Nvidia store has soared to about $1,200 a proportion — up 287% for the reason that chip fashion designer’s boffo Might 2023 income record kindled generative AI fever.

With the store eager to shed to about $120 in step with proportion Monday — when the corporate’s 10-for-1 cut up is going into impact — will its store value ever go back to $1,200?

Listed below are 4 causes that would occur through 2026 — the primary is fresh, and the terminating 3 are nonetheless legitimate since my Might Forbes submit:

- Governments are fearful of falling in the back of within the race to grasp generative AI. Their chip purchases have added to Nvidia’s earnings, consistent with the Wall Street Journal;

- Nvidia’s superb efficiency and possibilities;

- Nvidia’s a success expansion investments; and

- CEO Jensen Huang’s management — which may be Nvidia’s greatest funding possibility must he let fall the task with out a extra succesful successor.

One alternative possibility is trade leaders’ bipolar angle against generative AI.

How so? CEOs host competing fears. They’re fearful of being left in the back of the generative AI growth whilst the possibility of AI hallucinations may savage their corporate’s company reputations.

This rigidity may create it tricky for them to put in force prime payoff generative AI packages, consistent with my fresh secure, Brain Rush: How to Invest and Compete in the Real World of Generative AI.

With out that, call for for Nvidia’s era might be tricky to maintain.

Independent AI Added $10 Billion To Nvidia’s Income

Had been Nvidia store — in an constructive situation — to accumulation emerging on the 287% annual price it loved between Might 2023 and terminating Friday, the corporate’s post-split stocks may lead $1,200 someday in 2026, consistent with my research.

Here’s a fresh supply of expansion to gasoline that get up: Governments in Asia, the Heart East, Europe and the Americas are purchasing GPUs en masse as they form home computing amenities for synthetic knowledge, famous the Magazine.

The will through international locations to manufacture detached AI through coaching immense language fashions in their very own language with voters’ information is using this call for. Underlying this crucial is “a quest for more strategic self-reliance amid rising tensions between the U.S. and China,” the Magazine wrote.

Nvidia expects detached AI spending to spice up 2024 earnings through $10 billion, the corporate mentioned terminating era. If international locations’ call for to form their very own generative AI functions continues to extend, such spending may support Nvidia to diversify its earnings resources.

This earnings flow may maintain Nvidia’s talent to take advantage of the generative AI growth must call for from information facilities gradual. “The question has been, how can they continue this momentum?” Angelo Zino, an analyst at CFRA Analysis, instructed the Magazine. “Sovereign AI is a new lever out there in terms of generating higher revenue.”

3 Nvidia Enlargement Drivers

Along with detached AI call for for Nvidia chips, alternative drivers of Nvidia’s expansion, about which I wrote in my Might Forbes submit, come with:

- Expectancies-beating first-quarter effects and forecast. Within the first quarter of the corporate’s fiscal occasion 2025, Nvidia beat expectancies for 237% earnings expansion through $1.78 billion and reported a higher-than-expected improper margin of 78.4%, famous Yahoo! Finance. The corporate additionally forecast 197% earnings expansion for the flow quarter — exceeding analysts’ expectancies, the Magazine wrote.

- Nvidia’s expansion investments. Nvidia’s competitive generation of fresh product introductions will power year expansion. Examples come with Blackwell chips which Huang mentioned would generate “alot of revenue” for Nvidia in 2024 in conjunction with the corporate’s fast-growing InfiniBand sequence, I famous in Might. Nvidia’s 427% build up in earnings from cloud provider suppliers — which accounted for $22.6 billion in earnings, famous the Unused York Instances — may decelerate going forward. Since Huang is a Form The Age CEO, as I mentioned in Mind Quicken, a flow of fresh expansion investments may support maintain Nvidia’s expansion.

- Huang’s world-class management ability. Huang is on the lead of an overly elite category of leaders who discovered, remove it people, and conserve keep an eye on as CEO greater than 3 years nearest the corporate’s IPO, I famous in my Might column. His talent to introduce and promote industry-leading GPUs time browsing fresh waves of call for is phenomenally significance. Nvidia’s talent to maintain expectations-beating expansion is determined by him residue CEO — and in the long run appointing a successor a minimum of as gifted as Huang.

Can Corporations To find Top Payoff Generative AI Packages?

According to my interviews with dozens of industrial leaders, generative AI in firms is stuck in a bipolar fight, Mind Quicken famous.

Peer power forces CEOs to inform Wall Boulevard how generative AI will develop into their trade. On the similar life, CEOs are terrified the AI chatbots will hallucinate — thus destructive their corporate’s recognition.

This worry is founded in fact. As an example, Google’s AI urged community to add glue to pizza. And Air Canada’s AI chatbot made up a reimbursement coverage for a buyer — and a Canadian tribunal pressured the airline to factor an actual refund in keeping with its AI-invented coverage.

This bipolar fight has important implications for trade. Of 200 to 300 generative AI experiments firms are creating, they have got rolled out handiest 10 to fifteen internally, and exempt in all probability one or two to consumers and alternative stakeholders, consistent with my June 3 interview with Liran Hason, CEO of Aporia, a New york-based startup providing guardrails to offer protection to firms from AI hallucinations.

Except prime payoff packages emerge from this means of generative AI experimentation, the flow of call for for Nvidia’s GPUs may taper off over the long term.

Within the period in-between, trade and political leaders’ worry of falling in the back of within the generative AI race may power prime call for for Nvidia’s chips — and the corporate’s store.