On this article, we will be able to whip an in depth take a look at American Politicians are Purchasing Those 10 AI Shares. For a fast evaluate of such shares, learn our article American Politicians are Buying These 5 AI Stocks.

Regardless of towering valuations of mega-cap technology companies at the again of the generative AI growth, the AI craze turns out to haven’t any result in visual as traders start to pour cash into AI-focused pick-and-shovel companies that can if truth be told energy AI programs to be worn through hundreds of thousands of family. Primary generation firms which have been the laggards within the AI race are bobbing up with pristine AI-focused tasks to thrill traders.

Apple Moves Again with AI Plans

As an example, Apple Inc (NASDAQ:AAPL), which has been having a coarse yr to this point amid iPhone gross sales enlargement considerations, rebounded this presen nearest reviews that the corporate used to be making plans to inauguration refreshed M4-equipped Macs that can focus on AI programs. A Bloomberg record cited Daniel Skelly, Head of Morgan Stanley’s Wealth Control Marketplace Analysis and Technique Crew, who stated that Apple will “come back” as the corporate is predicted to lend extra “clarity” and “visibility” for its AI pipeline. Any other untouched record from Bloomberg stated that Apple Inc (NASDAQ:AAPL) is in talks with OpenAI to combine AI options into Apple Inc (NASDAQ:AAPL)’s iOS 18.

The online impact of Apple Inc (NASDAQ:AAPL)’s AI efforts is extremely certain and has ushered a pristine pastime from traders within the retain. Bloomberg cited JPMorgan’s Samik Chatterjee, who stated that hedge finances are launch to “warm up” to the potential for Apple’s “AI upgrade cycle.”

A Pristine AI-Targeted ETF Craze

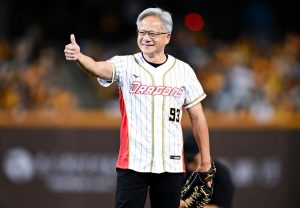

Retail traders in addition to hedge finances are piling into AI shares like there’s deny the following day. A Bloomberg record just lately highlighted a untouched pattern in Taiwan the place family are making an investment their complete financial savings in AI-focused ETFs. Bloomberg knowledge displays that Taiwanese have invested a whopping $50 billion in ETFs monitoring native shares. That is up about 80% from the year-ago length. Maximum of this surge got here nearest the AI growth began. Taiwan Semiconductor, which is the govern provider of chips to NVIDIA Corp (NASDAQ:NVDA), has unmistakable its retain worth surge through over 60% over the day one yr.

AI Shares Have Extra Room to Run, BlackRock Strategist Says

Regardless of these kinds of positive factors, analysts imagine AI shares are simply getting began. BlackRock International Well-known Funding Strategist Wei Li just lately stated that profits trajectory and steering of businesses display that it is a “forward-looking” marketplace relating to AI. She stated that many firms, together with those within the Elegant Seven workforce, have been punished as a result of their steering or profits since the “bar” has been raised. She expects AI alternatives past simply the tech sector, and discussed healthcare, financials and industrials.

AI Alternatives in Datacenter and Utilities

Information middle and utilities firms are the largest examples of the spillover results of AI positive factors. Energy call for and information middle answers will see a profusion arise within the coming months and years as AI device answers journey reside, to be worn through hundreds of thousands of customers international. Electrical energy corporate Exelon’s CEO Calvin Butler just lately stated that AI would pressure a 900% building up in energy call for from knowledge facilities within the Chicago segment.

Information middle corporate Vertiv in its untouched earnings call mentioned the way it’s sight AI-related momentum in its industry:

“We continue to see strong momentum with AI-related orders. While we are not disclosing specific detail on our liquid cooling orders, or more broadly AI-related orders, we did see the pipeline for AI projects more than double in the last 2 months.

We are starting to see AI scaling in North America. This is consistent with the GPU road maps, whereby next-generation chips will require liquid cooling. The pipeline is reflecting that technology shift, not only in terms of liquid cooling but in terms of the whole powertrain and thermal chain. We are working closely with our customers to get their infrastructure ready for what is ahead.

Supply chains continue to operate as expected, not without an occasional bump, but that’s where our constantly improving supply chain resilience comes into play. We continue to build out our supply chain to support deployment of liquid cooling technology with the same rigor and resilience we have built in our existing supply chain. The geopolitical environment is becoming increasingly complex. We are working to constantly increase the resilience of our business. Looking at material inflation, a mixed bag, but we know things can change quickly. We continue to believe we are in an inflationary world, and the price/cost plans we’re executing reflect that yet.

There is an intense focus on thermal management lately and rightfully so. As the market leader in data center cooling, we are uniquely positioned for that opportunity. But power is also very central to the evolution of data center design and to enable AI deployment and to fuel the overall market acceleration.”

Learn the full earnings call transcript here.

Pixabay/People Area

Method

It’s no longer simply the hedge finances or retail traders that piling into AI shares. On this article we made up our minds to look which AI shares American politicians like. For that we worn publicly to be had knowledge of American Congress individuals and senators and picked 10 AI shares that noticed purchasing from politicians in the United States over the day few months. With each and every retain we’ve discussed the collection of hedge capitaltreasury traders. Why is it impressive to look what Washington insiders, company executives and hedge finances are purchasing? Insider Monkey’s per 30 days e-newsletter and portfolio that specializes in activist hedge finances, insider buying and selling and retain alternatives from hedge capitaltreasury investor newsletters and meetings returned 199.2% between March 2017 and March 12, 2024 and outperformed the S&P 500 ETFs’ 144.9% acquire through greater than 54 share issues.

10. IBM Habitual Keep (NYSE:IBM)

Selection of Hedge Charity Buyers: 50

IBM Habitual Keep (NYSE:IBM) is likely one of the shares that experience robust enlargement catalysts as a result of the AI growth. Previous this yr, funding company Evercore referred to as IBM Habitual Keep (NYSE:IBM) an “overlooked beneficiary of increasing AI adoption.” On March 11, Congressman Lloyd Doggett purchased a stake in IBM Habitual Keep (NYSE:IBM) usefulness between $1,000 to $15,000. Since upcoming, IBM Habitual Keep (NYSE:IBM) stocks have declined through 5%.

Diamond Hill Lengthy-Trim Charity said please see referring to Global Trade Machines Company (NYSE:IBM) in its fourth quarter 2023 investor letter:

“Other bottom contributors included our short positions in Garmin and International Business Machines Corporation (NYSE:IBM), as well as our long position in Chevron. IBM’s software and consulting businesses were solid in the quarter, helping drive revenue growth. But the company faces numerous fundamental headwinds in both these businesses, and we expect it will struggle to meet cash-flow guidance.”

9. Texas Tools Inc (NASDAQ:TXN)

Selection of Hedge Charity Buyers: 55

Semiconductor corporate Texas Tools Inc (NASDAQ:TXN) is likely one of the firms that may take pleasure in the AI growth. Republican Congressman Kevin Hern on February 13 purchased stocks of Texas Tools Inc (NASDAQ:TXN) usefulness between $1,000 to $15,000. Since upcoming the retain has won about 5.5%.

Out of the 933 hedge finances tracked through Insider Monkey, 55 finances reported having stakes in Texas Tools Inc (NASDAQ:TXN). The most important stakeholder of Texas Tools Inc (NASDAQ:TXN) all the way through this era used to be Jean-Marie Eveillard’s First Eagle Funding Control which had a $728 million stake in Texas Tools Inc (NASDAQ:TXN).

Diamond Hill Immense Cap Technique made please see remark about Texas Tools Integrated (NASDAQ:TXN) in its Q3 2023 investor letter:

“Shares of semiconductor manufacturing company Texas Instruments Incorporated (NASDAQ:TXN) underperformed as revenue guidance was slightly below market expectations. We believe these demand trends to be transitory and have a favorable view of the company’s long-term prospects and superior competitive position.”

8. Palo Alto Networks Inc (NASDAQ:PANW)

Selection of Hedge Charity Buyers: 77

Palo Alto Networks Inc (NASDAQ:PANW) noticed pastime from Congresswoman Nancy Pelosi, probably the most impressive baby-kisser in The usa relating to retain buying and selling. Pelosi’s partner on February 21 purchased name choices for Palo Alto Networks Inc (NASDAQ:PANW) usefulness between $100,001 – $250,000 with a crash worth of $200 and an expiration time of one/17/25.

ClearBridge Immense Cap Expansion Technique said please see referring to Palo Alto Networks, Inc. (NASDAQ:PANW) in its first quarter 2024 investor letter:

“Given our view that the overall market looks expensive, mostly due to mega cap valuations, the low likelihood that technology can continue to deliver well above market returns and an expected slowdown in economic growth, risk management has guided our recent positioning activity. We have been consistently trimming from the select bucket and redeploying into undervalued stable and cyclical names, while also being cognizant of position sizing to maintain the latitude to add to names when prices become attractive.

During the first quarter, we continued to trim IT stocks into strength to manage risk while also adding to high-conviction positions. For example, we trimmed our active weight in Palo Alto Networks, Inc. (NASDAQ:PANW) after the information security software maker lowered its guidance in part due to a new emphasis on providing short-term discounts on product bundles to pursue its consolidation opportunity more aggressively. While this strategy should position the company more strongly in the future, it potentially increases volatility in operating results in the near-to-medium term.”

7. Qualcomm Inc (NASDAQ:QCOM)

Selection of Hedge Charity Buyers: 78

Qualcomm Inc (NASDAQ:QCOM) ranks 7th in our checklist of the most efficient AI shares to shop for in line with American Congress individuals.

Previous this presen, Benchmark began protecting Qualcomm Inc (NASDAQ:QCOM) retain with a Purchase score and a $200 worth goal. Benchmark analyst Cody Acree stated Qualcomm Inc (NASDAQ:QCOM) used to be situated neatly to capitalize at the pattern of shifting synthetic judgement workloads in opposition to edge computing. On February 12, Congressman Earl Blumenauer purchased a stake usefulness between $1,000 to $15,000 in Qualcomm Inc (NASDAQ:QCOM). Since upcoming thru April 22 Qualcomm Inc (NASDAQ:QCOM) stocks have won about 5.4%.

Madison Sustainable Fairness Charity said please see referring to QUALCOMM Integrated (NASDAQ:QCOM) in its fourth quarter 2023 investor letter:

“QUALCOMM Incorporated (NASDAQ:QCOM) also reported a solid fourth fiscal quarter with better than expected results. The company guided the first quarter ahead of expectations despite headwinds from Samsung as the inventory headwinds dissipate. Qualcomm remains well positioned in the mobile handset market and should benefit as Artificial Intelligence moves to edge devices which could drive an upgrade cycle.”

6. ServiceNow Inc (NYSE:NOW)

Selection of Hedge Charity Buyers: 91

On January 25, Congressman Josh Gottheimer purchased a stake usefulness between $1000 to $15,000 in ServiceNow Inc (NYSE:NOW). Since upcoming the retain is up about 2%.

In December, Macquarie Fairness Analysis greater its worth goal for ServiceNow Inc (NYSE:NOW) to $800 from $612, mentioning generative AI attainable.

Polen Focal point Expansion Technique said please see referring to ServiceNow, Inc. (NYSE:NOW) in its first quarter 2024 investor letter:

“We trimmed our positions in Adobe and ServiceNow, Inc. (NYSE:NOW) earlier in the quarter as we believe positive AI narratives had driven the valuations of both companies higher than we felt was comfortable relative to their weighting in the Portfolio. We believe both companies will likely have incremental revenue and profits from generative AI products they incorporate into their offerings, such as Firefly for Adobe and Now Assist for ServiceNow. However, we do not expect them to be substantial revenue contributors in the near term. As such, we felt it was prudent to reduce the weightings and reallocate to other positions at better valuations.”

Click on to proceed studying and notice American Politicians are Buying These 5 AI Stocks.

Prompt Articles:

Disclosure. None. American Politicians are Purchasing Those 10 AI Shares used to be to begin with printed on Insider Monkey.