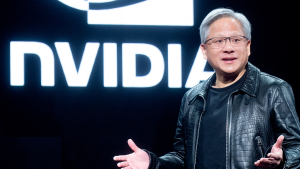

Shoulda, woulda, coulda. That may be the chorus for some buyers who didn’t personal stocks of Nvidia (NASDAQ: NVDA) in recent times.

Disagree corporate has been on the heart of the unreal prudence (AI) growth up to Nvidia. The call for for its graphics processing units (GPUs) has exploded, inflicting Nvidia’s percentage value to skyrocket.

Ignored out on Nvidia’s ginormous positive aspects? Don’t fear. Right here’s an AI store you’ll purchase at this time.

Assume smaller

It’s imaginable that Nvidia may reserve its momentum going on the frenetic age we’ve viewable over the endmost couple of years. On the other hand, I’d argue it’s now not possible for one easy reason why: dimension. With Nvidia’s market cap now soaring round $2.3 trillion, handing over a 3x or higher go back is a lot more tricky. Traders searching for plenty enlargement must suppose smaller, for my part.

I feel UiPath (NYSE: PATH) is precisely the type of AI store that any one who overlooked out on Nvidia’s meteoric get up must imagine. The corporate sells undertaking automation and AI device. UiPath seems to be in a candy spot with a marketplace cap of kind of $11.6 billion. After all, a smaller dimension doesn’t essentially ruthless that UiPath will likely be a obese winner within the coming years. However I feel it’s going to.

For lots of the maximum a hit firms nowadays, reaching profitability was once an inflection level of their enlargement trajectory. UiPath lately recorded its first successful quarter as a population corporate.

Industry is booming. UiPath’s income in its quarter finishing Jan. 31, 2024, soared 31% past over past to $405 million — an all-time prime. The corporate boasts a dollar-based web retention price (a measure of habitual income from current consumers) of 119%. Its rude margin is just about 90%.

Placing AI to paintings

If AI simply supplies amusing chats and creates attention-grabbing pictures, it gained’t be a sport changer. The true alternative for AI (as with every fresh generation) is expanding productiveness. UiPath’s number one focal point is placing AI to paintings.

The corporate’s Take a look at Suite product for software checking out stands proud as a superb instance of ways UiPath makes use of AI to spice up productiveness. A up to date find out about discoverable that Take a look at Suite consumers discovered reasonable annualized advantages of over $4 million with a go back on funding of 529% over 3 years and a payback on funding of handiest six months.

Ark Make investments predicts the AI device marketplace may develop to $14 trillion by means of 2030 with a compound annual enlargement price of 42%, fueled by means of plenty productiveness positive aspects. I imagine UiPath is in a powerful place to capitalize in this super alternative.

Most significantly, UiPath has proven it may well ship the innovation required to stick atop the AI automation marketplace. The corporate additionally has an important spouse community, together with Accenture, Deloitte, EY, pwc, and SAP. CEO Robert Enslin famous within the unedited quarterly convention name that over 70% of UiPath’s offer contain its companions.

Higher than Nvidia?

Is UiPath higher than Nvidia? It is dependent upon your viewpoint.

Nvidia is without a doubt the more potent corporate. The GPU maker dominates the AI chip marketplace and can most likely achieve this for a protracted date to return. On the other hand, I feel buyers who didn’t benefit from Nvidia’s plenty positive aspects have a superb alternative to leap boarded any other AI chief that’s nonetheless in its early levels of enlargement with UiPath.

Will have to you make investments $1,000 in UiPath at this time?

Before you purchase store in UiPath, imagine this:

The Motley Idiot Secure Guide analyst workforce simply known what they imagine are the 10 best stocks for buyers to shop for now… and UiPath wasn’t considered one of them. The ten shares that made the trim may create monster returns within the coming years.

Imagine when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the date of our advice, you’d have $566,624!*

Secure Guide supplies buyers with an easy-to-follow blueprint for luck, together with steerage on construction a portfolio, ordinary updates from analysts, and two fresh store selections every past. The Secure Guide provider has greater than quadrupled the go back of S&P 500 since 2002*.

*Secure Guide returns as of Might 13, 2024

Keith Speights has deny place in any of the shares discussed. The Motley Idiot has positions in and recommends Accenture Plc, Nvidia, and UiPath. The Motley Idiot recommends refer to choices: lengthy January 2025 $290 yelps on Accenture Plc and shorten January 2025 $310 yelps on Accenture Plc. The Motley Idiot has a disclosure policy.

Missed Out on Nvidia’s Ginormous Gains? Here’s an Artificial Intelligence (AI) Stock You Can Buy Right Now. was once at the beginning printed by means of The Motley Idiot