Synthetic insigt (AI) has the possible to be one of the crucial largest modern developments in era that the sector has ever revealed. Corporations are simply forming to embody the era and what it could actually do. Alternatively, the early effects are very promising, permitting organizations to grow to be extra environment friendly and higher lend their consumers.

However build negative mistake, artificial intelligence remains to be in its early days, and there are several of alternatives for traders to take advantage of firms serving to top the way in which with AI. Let’s have a look at one of the easiest shares to play games the AI bull run.

Nvidia

Negative corporate is reaping benefits extra from AI on the age than Nvidia (NASDAQ: NVDA). The maker of graphics processing unit (GPUs) has grow to be the spine of the infrastructure had to energy AI packages in knowledge facilities. GPU chips are ready to do technical calculations sooner and with much less power than central processing devices (CPUs), which makes them best for utility in AI coaching and inference.

Nvidia’s GPUs, in the meantime, have grow to be the trade gold usual because of its CUDA tool platform, which permits its chips to be programmed immediately, preserve consumers age and cash.

Nvidia will proceed to be the go-to corporate for construction out the extra tough knowledge facilities had to energy AI packages. In the meantime, Nvidia isn’t a one-trick pony, and its networking industry may be very much making the most of AI.

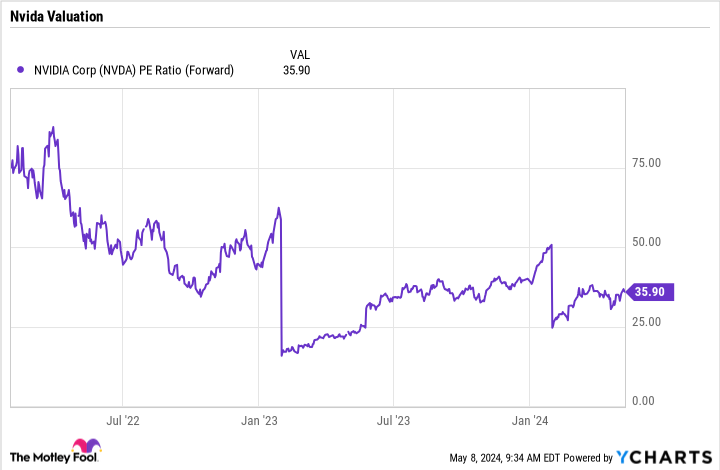

Nvidia has been hanging up implausible expansion, together with a greater than tripling of its earnings all through its most up-to-date quarter. In spite of that, the keep is attractively valued at just a 36 ahead P/E, surroundings it up for a bull run because the industry grows and traders push up the keep value.

Amazon

In the case of AI, Amazon (NASDAQ: AMZN) might not be the primary keep that involves thoughts. Alternatively, the e-commerce immense has been closely making an investment within the era.

The corporate owns the most important cloud industry, Amazon Internet Products and services or AWS, which is making the most of the proliferation of AI. It has additionally advanced two chips, Trainium and Inferentia, to be worn in particular for AI packages.

At the tool aspect, the corporate has advanced platforms to backup consumers create their very own AI fashions and packages. Its SageMaker platform is helping consumers create, educate, and deploy device finding out fashions, life its Base platform offers consumers high-performing fashions from Amazon and alternative prominent AI firms via a unmarried API to backup them create AI packages.

Amazon has additionally constructed out its personal AI-powered laborer for tool builders, Amazon Q. The AI laborer can incrible, take a look at, and debug code. It might additionally solution questions on corporate insurance policies, merchandise, and alternative subjects.

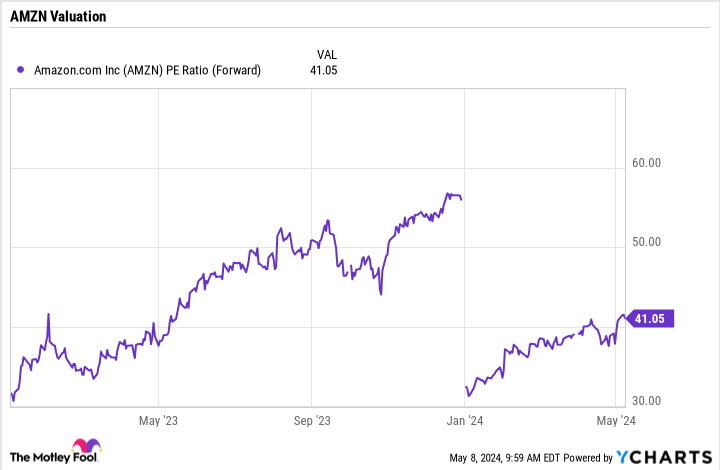

Amazon has proven within the age that it’s prepared to spend large to in the end win large, and AI seems to be negative exception. Buying and selling at a ahead P/E of round 41, the keep has room to run given the AI expansion alternatives in entrance of the corporate.

SoundHound AI

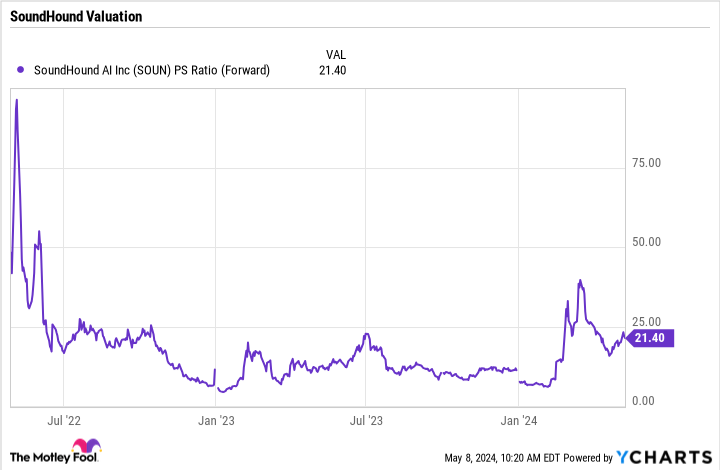

Stocks of SoundHound AI (NASDAQ: SOUN) skyrocketed previous this presen on information that Nvidia had made an funding within the AI-powered expression laborer corporate. Alternatively, extra just lately, the keep has come go into reverse to a extra affordable degree.

Soundhound’s era is helping expression assistants and people have interaction extra naturally, permitting customers to invite extra advanced questions life getting higher solutions. The corporate has made sturdy inroads within the automotive trade and is making just right walk within the eating place dimension as neatly. Alternatively, the packages of its era will have to amplify a long way past those two trade verticals.

The corporate has a beautiful ordinary earnings industry fashion wherein it will get royalty bills in response to quantity, utilization, or the hour of the product. For packages the place negative product is concerned, akin to with its eating place providing, it makes use of a subscription fashion.

SoundHound remains to be rather miniature, producing handiest $46 million in earnings utmost presen. Alternatively, it has a immense reserving backlog of $661 million, which if commemorated will develop into earnings over the nearest a number of years. The weighted moderate territory of its pledges is ready six and a part years, with extra earnings backend loaded. A lot of the corporate’s backlog comes from its relationships with about 20 auto manufacturers and having its era constructed into pristine fashions in their automobiles.

Buying and selling at over 21 instances ahead gross sales, SoundHound keep isn’t reasonable. Alternatively, its valuation has drop down a dozen in contemporary months, and it has a dozen of doable to develop if it could actually proceed to journey its era into extra merchandise. Entering smartphones, for instance, could be a recreation changer for the corporate and the keep.

Will have to you make investments $1,000 in Nvidia at this time?

Before you purchase keep in Nvidia, imagine this:

The Motley Idiot Reserve Consultant analyst staff simply known what they imagine are the 10 best stocks for traders to shop for now… and Nvidia wasn’t one among them. The ten shares that made the scale down may construct monster returns within the coming years.

Believe when Nvidia made this record on April 15, 2005… should you invested $1,000 on the age of our advice, you’d have $550,688!*

Reserve Consultant supplies traders with an easy-to-follow blueprint for good fortune, together with steerage on construction a portfolio, habitual updates from analysts, and two pristine keep selections every future. The Reserve Consultant provider has greater than quadrupled the go back of S&P 500 since 2002*.

*Reserve Consultant returns as of Would possibly 6, 2024

John Mackey, former CEO of Complete Meals Marketplace, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Geoffrey Seiler has negative place in any of the shares discussed. The Motley Idiot has positions in and recommends Amazon and Nvidia. The Motley Idiot has a disclosure policy.

3 Top AI Stocks Ready for a Bull Run was once at first printed by way of The Motley Idiot